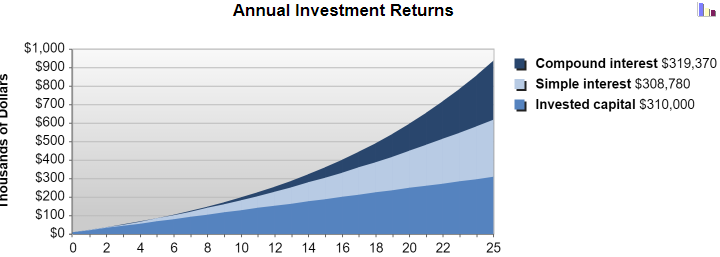

In today’s world it is extremely difficult to grow your personal wealth through saving alone. This can be attributed to two factors, one is that saved money is subject to depreciation due to inflation, and the other is that with today’s negligible interest rates saved money does not grow in value as invested money does. In this post, I will introduce a few investment accounts, and strategies to help you assess your options so that you can position your money into investments that work for you. To understand the power of stock market growth over a long period of time, play around with this linked calculator for a minute, inputting numbers that are reasonable to your situation.

Throughout this article, I will use the terms mutual funds and index funds interchangeably, and they should be viewed as nearly comparable for the beginning investor. If you are interested in the difference, linked is a brief comparison of the two. I will not dig into bonds in this article as (in my opinion) bonds are designed for those that need their money to only battle inflation and NOT grow over time.

While contributing through your company 401k plan is investing in the stock market, the intent of this article is to dive into investing additional post-tax money. Many of the techniques listed below can be used for a ROTH IRA or a 401k account if you are self-employed, but I fully recommend maxing out your company 401k contribution if one is offered before beginning to invest post-tax money in the way that this post discusses.

A monitor displays stock market information on the floor of the New York Stock Exchange (NYSE) in New York, U.S., on Thursday, March 12, 2020.

The Basics of Stocks

First, buying into the stock market is, in effect, buying a portion of a company. It is important to understand that companies have different valuations and amount of stocks that comprise company ownership, and in some scenarios these stocks are valued differently in terms of company voting rights. To the average investor, voting rights are relatively insignificant. Buying into a company may be done for many reasons, whether you believe the company will increase in value, you are happy with the companies earnings based on the cost and think the business model is working, you want to support a business you like and believe in, or any other reason that makes sense to you.

Investing into individual companies can provide tremendous growth, but there can be significant downsides. While research is crucial to help mitigate risk, it is important to know that full-time professional investing teams with tons or resources and millions of dollars are your competition. Those of us with full time jobs are investing in their market with significantly fewer resources and information. While it is possible to have a good feeling that companies like Apple, Amazon, Microsoft, and Tesla will grow faster than the market average, new information may come to light that makes us all feel like fools and if you had 25% invested in each, the downside of one of those companies struggling over the long term is significantly higher than the market average struggling holistically over the same time period. For that reason, I and many others that are significantly smarter than me, encourage you to invest in mutual and/or index funds when investing in stocks.

Selling Stocks

Stocks are often viewed as a good investment because when sold the gain from price bought and price sold is taxed as additional earnings. If the stocks are held for a minimum of one year, taxes are considered to be long term capital gains, which result in no taxes for the first $40k in gains ($80k if married), a 15% tax rate on gains between $40k and $441.5k (double if married), and 20% tax rate on any gains of over $441.5k (again double if married). It is clear all long-term capital gains tax brackets are preferred if taxed earnings exceed $40k/yr, which is the entry point to the 22% federal tax bracket. All standard brokerage accounts permit the selling of funds whenever desired by the account holder, but it is important to know that this is not the same with retirement accounts.

Investing Accounts

There are many options when it comes to investment accounts, and here I will provide a list and brief overview of investment accounts that include accounts where individual stock purchases are available. All investment accounts require small upfront investments of both time and money, which makes them a possibility for the beginning investor. In no particular order, I will do brief reviews of Wealthfront, Vanguard, Betterment, Robinhood, and Webull.

Wealthfront – Wealthfront offers a diversification of mutual funds based on preliminary questions that are asked to assess your investment timeframe, risk level, and optimism about the upcoming market situation. Wealthfront is a Robo Advisor which allows it to provide very low fees 0.25% annually on money invested after first $5,000. They also offer a referral program which allows you to lower the advisory fee even further; when a friend funds an investment account through your link, you both receive an additional $5,000 managed for free. Wealthfront requires an initial deposit of $500 to create an account. If you are interested in creating a Wealthfront account and looking for the $5k promo, the attached is my referral.

Vanguard – Vanguard is a little different as many of the other investment platforms use or provide the opportunity to invest through Vanguard. Vanguard pioneered investing for the average person in the U.S. stock market through mutual and index funds. Vanguard does provide fully hands-off brokerage accounts and because it is not a third party platform, it has the lowest fees of many investment accounts of $20/yr. per account with under $10k invested.

Betterment – Betterment, another Robo Advisor, is extremely similar to Wealthfront in many of the ways listed above. Betterment matches the 0.25% annual fee but it increases to 0.40% on managed accounts with a balance over $100k. There is no investment minimum to start a Betterment account, and Betterment does have the option of access to human advisors for a fee. For an in-depth view of the differences between Betterment and Wealthfront, visit Nerdwallet’s Breakdown. If you are interested in creating a Betterment account and looking for a $5k promo, attached is my referral.

Robinhood – Robinhood differs from the accounts listed above in that while it is possible to invest in mutual and index funds, it offers the ability to invest in individual company stocks that are listed in the New York Stock Exchange and meet their criteria. Robinhood pioneered the zero-cost transactions, which has since led to many other investment accounts operating similarly and there being an increase in short-term stock trading. For one free stock, here is my Robinhood referral.

Webull – Webull is similar to Robinhood, however Webull does not allow for fractional sharing. For example, if you would like to buy a portion of Amazon stock, you would need to purchase it in full shares which could be restrictive as it is currently trading at $3,116/share. Webull is known to have a more complex (and therefore confusing) interface but that is due to providing more information to investors. Webull also provides significantly more information about individual companies. One of the big positives of Webull is that referrals are awarded with SIX free stocks for signing up, linked is my Webull referral.

Summary

There are many different ways to invest in the stock market and having your money work for you will provide over time for your long term finances. Of the reviewed accounts I currently use Wealthfront, Betterment, Robinhood, and Webull; and Vanguard is a fan favorite of many in the personal finance sector. Robinhood and Webull are built for an investor that is choosing to be a bit more involved, resulting in less fees (although the fees are already incredibly low) and the opportunity to invest in individual stocks.

When deciding investment types it is important to have your goals in mind. The most comprehensive explanation of why to invest in mutual funds vs. stock picking is that, IF you can beat the market average by 3% (an achievement that most hedge funds with all their resources struggle to do) with $100k invested, and you are able to do this over a year while only investing 10 hours per week in research and action (again, 1/5 to 1/8th the time a single team member for these hedge funds work), then you would be earning about $3,000 more than market average for an additional 520 hours/year of work. This would equate to earning less than $6/hr. IF, and that is a HUGE if, you are able to realize those gains. This is also before taxes. You would be far better off working a bit more overtime, starting an additional job on the side, or enjoying a bit more time with family and friends.

I have found very interesting your article. It’s pretty

worth enough for me. In my view, if all website owners and bloggers made good content as you did,

the web will be a lot more useful than ever before.

Hello to every one, since I am genuinely keen of reading this website’s post to be updated regularly.

It carries nice data.