Credit can certainly be a very powerful tool in the modern economy we live in. It offers us the ability to leverage debt to fund our lifestyles and at times even provides better returns than if we were to not leverage debt at all. Most often that is experienced through credit cards and the preferential treatment for loans which are only available to those who demonstrate responsibility with debt such as… well, credit card holders. But be warned, yes there are many advantages to using credit that outweigh the benefits of using cash however powerful tools can be just as powerful weapons. If you make even a small mistake in managing your credit, such as missing a payment, then that may send you down the wrong trajectory which could mean having to pay high interest and not qualifying for car loans, mortgages or even renter applications. Be careful and be responsible.

The basics

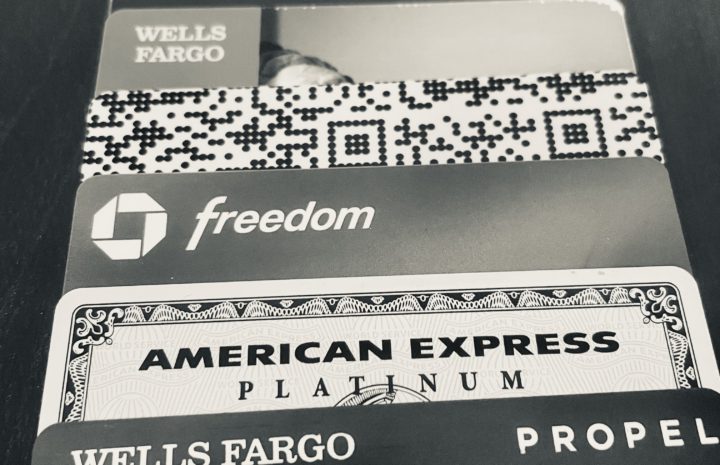

When you use cash or debit you are ultimately loosing out on an opportunity to save money. By having credit cards that earn you rewards, cash back and perks, often at no cost and with no fees if paid off like you would with a debit card, you are essentially getting anywhere from 1 to 5% back in benefits which you otherwise would be loosing if paying with cash. Even if you disagree, having a credit card with no rewards and no benefits (and no annual fee) is still benefiting you in that it is creating credit history which will help you get a discounted rate when applying for loans in the future. For these two reasons alone it is why I recommend having credit cards to all my friends and family. I will highlight some of the main benefits of credit cards and explain the basics of credit reports so that you can see how I have personally benefited from my decade long journey with credit. Just remember, everyone is different and will all have a unique credit journey based on our choices and beliefs. My suggestions are based on capturing the most reward for the least cost in financial terms. Some might argue the data you allow financial companies to capture about you by leveraging credit is not worth the 5% or so you might save and I respect those with that belief… mostly because they live under a rock if they really think advertisers can’t get their data in ways that don’t involve financial records and last time I checked it is cheaper living under a rock than having to finance a home with a mortgage that you can only get once you prove credit worthiness. Jokes aside, there are valid arguments against credit cards, especially among those who are unable to use credit responsibly and those who by circumstance have to pay more to sustain their livelihood than they make through wages.

This post will go over the basic stages of establishing your credit. When you are at the point of opening a new card to get higher return on your spend consder reading articles about the credit cards we recommend for the categories you are most intreated in (e.g. Cash Back, Travel, Perks, low APR, etc.)

Beginning your credit journey

Plain and simple, the earlier you start your credit the better. As soon as you are old enough to have a credit card you should consider opening a student card or having your parents add you to their credit card line. For the most part building your credit is just a game of waiting all while making sure you are paying off your balances in full each month. Additionally as your credit begins to age you should start monitoring it so that you know when your credit score is high enough to open another account. there are countless companies that offer free credit scores and credit reporting. There will likely be a blog post highlighting them so stay tuned.

Advancing your credit portfolio

Your credit score is compromised of five main criteria:

Payment History- e.g. How many on time payments are on your record.

Credit utilization- e.g. how much or little of your credit limit you use (keep this below 30%)

Age of credit- e.g. How old is your oldest line of credit and what is the average age of all your open accounts

Breadth of credit- e.g. Do you have a mix of credit cards and loans

Recent use of credit- e.g. Have you been applying for new credit in the past year

Focus on improving those factors in the order they are listed an your credit score will go up over time.

Once you reach a point in which your credit score is high enough to qualify for credit cards with rewards or loans at cheaper rates it is time to advance to the next phase of your credit journey. There is a fly wheel effect with good credit in that once you get there it becomes a virtuous cycle that produces more and more benefits for you over time. Good credit gives you the opportunity to have more credit, which leads to more diverse credit and with a time longer credit history (a thick file as credit card companies call it) from there you have more opportunities available to you with your strong credit history such as higher tier credit cards and cheaper loans and as you open some of those the cycle continues. FYI this is true but also not infinite and there is a balancing act so don’t go too crazy opening every card you can because that will hold you back and stall the flywheel, stay tuend for a blog post that will explain the sweet spot ,for now don’t fly too close to the sun.

The flywheel

Good credit -> longer and diverse credit history -> More financial opportunities

saving money, earning rewards, getting perks

(Image coming soon)

Maintaining your credit health

You will reach a point in which you have accomplished your top financial goal which for most will be either qualifying for their dream credit card, buying a house or getting a good deal on a car loan. From that point other goals will seem more distant (i.e. you probably wont be looking to buy a home within two years of buying your last one). You are now in a position to be strategic with your credit and maximize your rewards in the same way you would invest your money. You can hedge against the possibility of needing to buy or finance a large purchase by maintaining a score comfortably above 760 so you can get the best rate when that moment comes, or you can get really close to 760 by opening multiple credit cards with rewards and sign up offers but then be at risk of not getting the most competitive rate when your car breaks down and you need to finance a new one. At this point having a budget and data/insights on your cash flow and spending trends becomes very important in order for you to capture the most gains from credit card offers. For me this is the point that I am at in my credit journey so you can expect most my credit card related posts to be related to this phase of the credit card journey.

For those chasing the perfect score of 850, to my knowledge there is no real benefit to that high of a score and even if there was it wouldn’t be worth the lost opportunity of opening a new card with great perks, also I’m pretty sure you need at least 20 years of credit before you get to the point that 850 is possible so have fun waiting if that is your goal.

Here is an example timeline for context. This is not definitive and you can probably put a two year buffer on either end for each phase depending on how closely you plan to monitor your credit and how much you are willing to devote to your credit strategy.

Time since your first line of credit

Year 0-4 Beginning phase

Year 4-8 Advancing portfolio phase

Year 8+ The balancing act/ maximizing benefit from the flywheel

On a final note, just remember that your credit score is not the ultimate measure of you as person or honestly even a measure of how good you are at credit. There will be people who get phenomenal deals with a 680 and people with a 760 who struggle to get the credit card they want. Balance is the and sustained growth over time is the best way to achieve that. Don’t fret (or gloat) about your score, use it as litmus test to guide you to the point that your credit score doesn’t drastically shift by 20 points every time you sneeze

Fabulous, what a web site it is! This web site provides useful data

to us, keep it up.