Why Budgeting is Important

Building from tracking, budgeting tends to be the next logical step. There are a lot of free guides out there, but one thing I would like to highlight is that budgeting will be different for every person, and it is important before starting to budget to have a good understanding of your financial goals.

How to Get Started

Whether that goal contains activities such as buying a car, a house, starting a family, being able to travel and visit friends that have inevitably spread out through the country, and then across the world, they will all cost money, and significantly more than you were spending in school. Sit down and in five minutes, write down a list of the events you believe are important that you would like to achieve, and please DO NOT forget retiring and the age you would like to retire! This list is likely to change over time and the specifics do not have to be set in stone, but this list should give you a chance to dream and set lofty goals, and then also realize that the loftier your goals are (and this is by no means a bad thing), the more money it will require to achieve those goals.

Many people starting out in their first jobs will struggle and realize that after all the hard effort they exerted in school, they are entering the job market and are immediately at the bottom of ladder in their new position. This will be hard and while you won’t necessarily be fetching coffee and making copies (although this is a possibility depending on your line of work), the work will probably end up being less emotionally fulfilling than you had built up in your mind. This often leads to seeking excitement and fulfillment outside of work, a task that will usually cost money.

Simple Budgeting

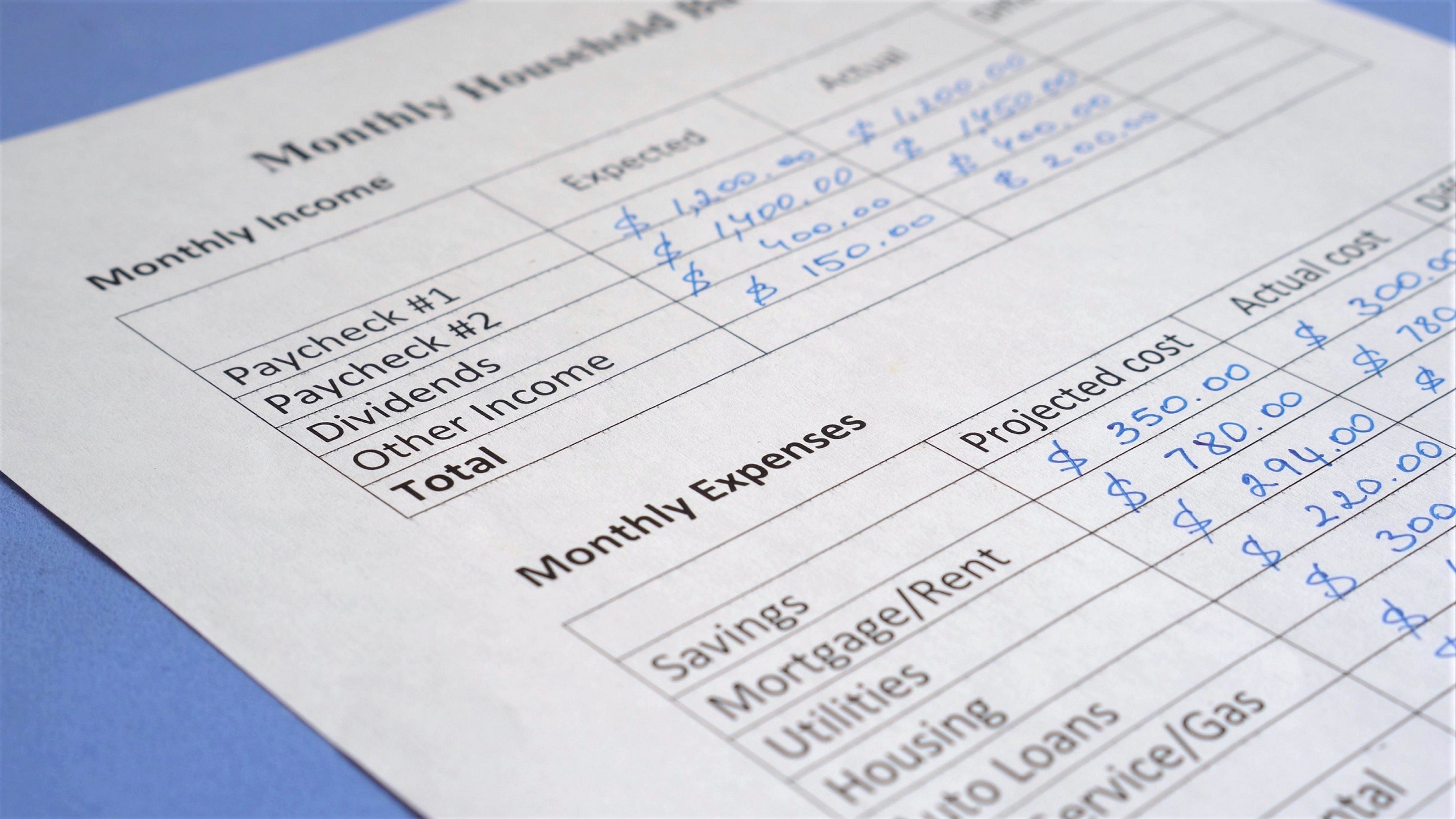

After you have a grasp of all the thinking and planning that goes into deciding how you would like to live your life and what you would like to accomplish, it is time to start coming up with a budget. The standard budget many people preach is the 50/30/20 budget, with 50% of your income being directed into needs (rent/mortgage, food, housing, transportation, insurance), 30% to wants (travel, weekly happy hour, gifts), and 20% to savings or debt repayment. The problem I have with this is that 20% is way too little to get ahead in life and more importantly SAVINGS AND LOAN REPAYMENTS SHOULD NEVER COME LAST.

My Take on Budgeting

While it may feel good to have a new car and nice clothes, these will not help you be more financially secure. I strongly recommend 15% into your retirement account at a minimum while ALWAYS taking full advantage of your company’s 401k match if they have one. With 35% of your income, any debts should then be tackled based on interest rates they are growing at, and if not you should build up a savings fund of 6 months expenses and then, once those are finally completed, invest. If you start with saving 50% of your earnings while investing in your 401k, not only will you lower your taxable income, you will build up a platform of strength and security that will allow you to be proactive with life decisions instead of retroactive. And saving is not always putting money in a savings account. To some, this may be debt repayment, to others it may be building up an emergency fund, and hopefully after those are done, savings will mean putting aside money to be invested.

With the remaining 50% of your income, you are free to spend it on necessities and desires. These will range from housing to vehicles, food, clothing and travel. This 50% should bring joy and comfort, and everything that is spent with it should be appreciated or relocated to other items that will bring happiness. Giving and charitable donations are also strongly recommended, as there are a lot of causes and organizations that do fantastic work and are always short on funding. It is amazing how this may seem like an impossible task to achieve 10 years into the workforce but if you can start early on the benefits will be immense.

I do realize that being able to save is a privilege that not everyone can afford at all phases in life. It is extremely hard to save if working through school, supporting dependents on a low salary, or having big expenses. If this is going to be a long term situation though changes should be made to increase income, decrease spending, or hopefully both.

Budgeting Tips

Saving large amounts I have found is significantly easier when transferring money into savings, debt repayment, or investments is automated. Contributions to a 401k account can be automated through most employers’ payroll systems, payroll can be split into multiple saving/checking accounts, and direct deposits into investments account are always encouraged. If income is variable and expenses are not, planning ahead will become key with the understanding that it is significantly easier to retroactively spend than to retroactively save and invest.

Walking, biking, or taking public transportation can significantly reduce your transportation budget. If you find yourself not driving often after utilizing other modes, it may be significantly cheaper to not own a car. Instead consider using rideshare, asking a friend for a ride, or renting a vehicle when completely necessary.

Housing is often a big portion of personal spending. Reductions can be made by researching locations that may be a little older or quirky, living with housemates, or increasing commute distance. For those that are extremely industrious, the idea of house hacking is a possibility where you purchase a property and rent out parts so that hopefully the incoming rents cover all if not most of the mortgage payments. The ability to house hack vastly depends on location and creativity, and it has been proven that house hacking can work in some of the most expensive markets in the US including Seattle, San Francisco, LA, and New York City.

Reducing one’s food and drink budget is possible by being very conscious. Eating at restaurants or getting takeout will generally cost more than preparing food from scratch, just as preparing drinks at home will be cheaper than going out to the coffee shops and bars all the time. Set yourself a spending limit, and this doesn’t necessarily mean that you should cut out restaurants, bars, and coffee shops completely but going out should be conscious. If you need some assistance finding healthy meals on a budget, I highly suggest viewing the 5 Dollar Dinners website for ideas.

Lastly, I find it hugely beneficial to know what I am saving. Linked is a calculator that will help project investments over time. Seeing the future value what my investments should return in 5, 10, 20, and 30 year time frames makes me exceptionally motivated to make sure I keep save and invest for the long term future.