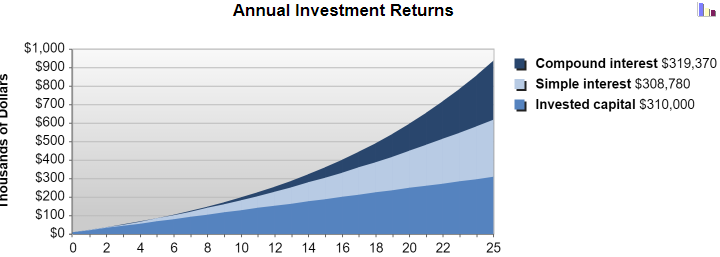

In today’s world it is extremely difficult to grow your personal wealth through saving alone. This can be attributed to two factors, one is that saved money is subject to depreciation due to inflation, and the other is that with today’s negligible interest rates saved money does not grow in value as invested money does. …

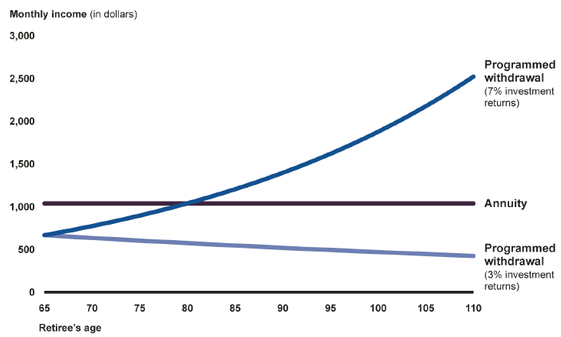

Planning on Retirement Based on the 4% Rule

The 4% rule has been one of the main guidelines for those in the Financial Independence movement as an indication for retirement preparedness. Bill Bengen is credited with inventing the rule originally in 1994, and the rule has consistently been criticized since its origination. To understand what this means, it is good to understand what …

What To Remember About Investing During a Bull Market

As we continue through this bull market it’s very easy to think that we are good at investing when all the stock we buy after a couple of research searches jumps up 10% every month. It is easy to become disillusioned in times like this and forget a couple key pieces of advice handed down …

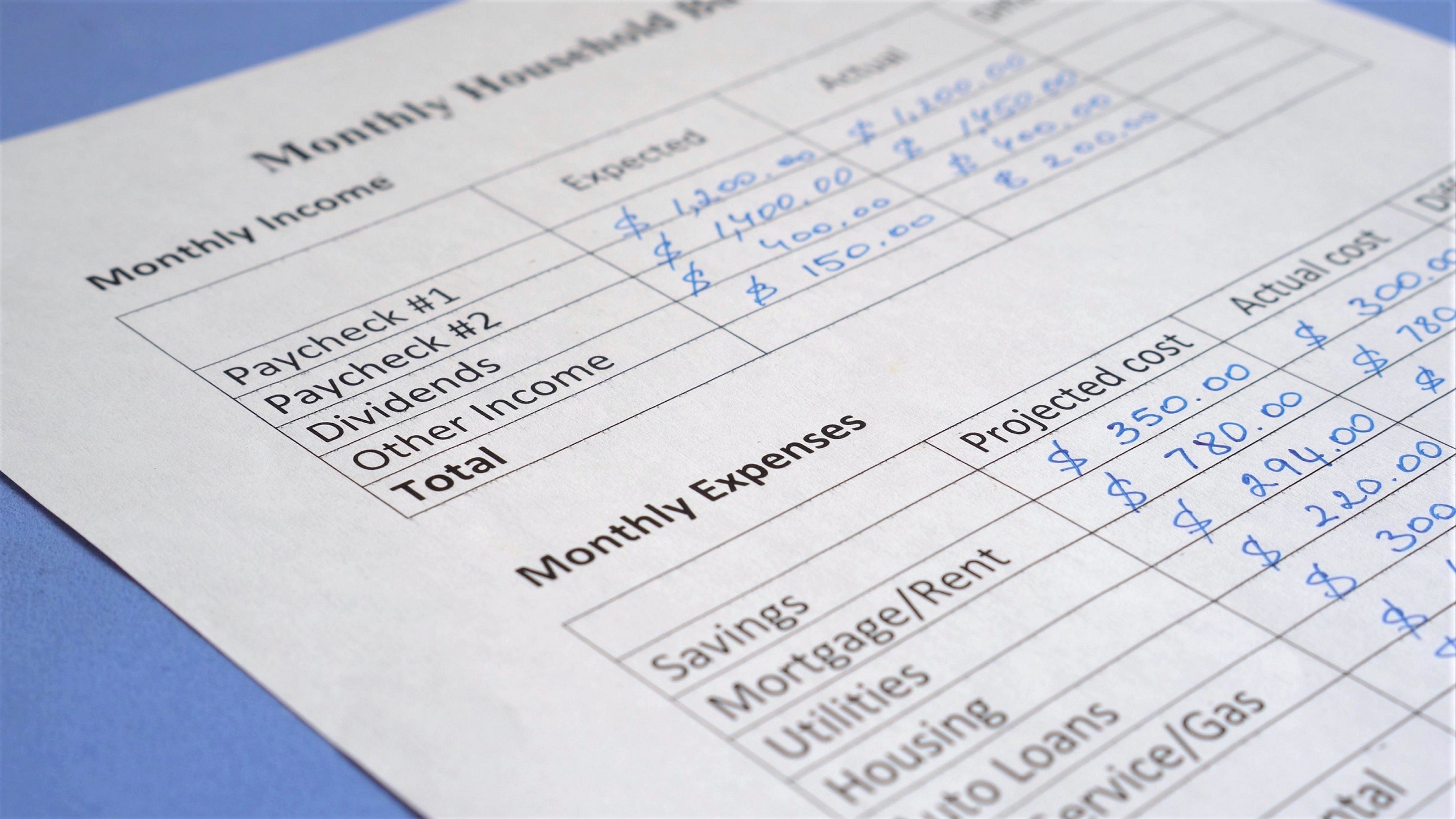

Tracking Spending 101

Why Tracking Spending is Important Potentially one of the biggest moments of change in our personal finance life is when school ends and we enter into the job market. This may be after high school, community college, university, graduate school, or post graduate school, but this new phase of life will almost always contain a …

Budgeting 101

Why Budgeting is Important Building from tracking, budgeting tends to be the next logical step. There are a lot of free guides out there, but one thing I would like to highlight is that budgeting will be different for every person, and it is important before starting to budget to have a good understanding of …