The 4% rule has been one of the main guidelines for those in the Financial Independence movement as an indication for retirement preparedness. Bill Bengen is credited with inventing the rule originally in 1994, and the rule has consistently been criticized since its origination. To understand what this means, it is good to understand what the 4% rule is, how it is calculated, and what the limitations are when being used.

The Basics of the 4% Rule

Fundamentally, the 4% rule is a general guideline to give people an understanding of how much money they need to successfully plan for retirement. It was deemed back in 1994, that a safe way to retire would be to plan on withdrawing 4% of your retirement savings annually. This would require someone that is planning to retire to track and project spending that will occur in retirement and have 25x that invested from locations that can be gradually withdrawn from. For someone intending to spend $50,000 per year in retirement, the 4% rule would result in having $1,250,000 invested to draw on.

The model was built around having an invested split of 60% stocks and 40% bonds. Theoretically, the recommended investment strategy from 4% rule believers is to have 60% in the stock market (SMP 500 mutual funds are the most recommended) and 40% diversified through bonds. This composition provides the stocks for growth and bonds as a form of recession insurance so that retirees are not forced to sell at market lows and instead wait for a rebound.

How the 4% Rule is Calculated

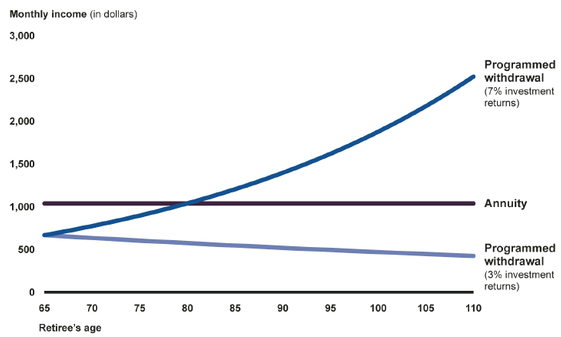

With a 4% withdrawal rate, the market typically averages 7% annually, and inflation averages 2-3% annually meaning that a new retiree would never need to actually withdraw from the invested principal. Instead, the earnings from the invested money should theoretically be sufficient to provide the desired life with 2-3% annual raises in spending to account for lifestyle adjustments caused by inflation. It should be noted that clearly, the stock market does not return 7% annually, this is an average. Historically, this 4% rule takes into account the worst market crashes of the 20th and 21st century, and while this sounds like good news, it is also hyper-conservative. Retiring on the 4% rule at 65 should be viewed as fool-proof while retiring on the 4% rule at 40 may be considered a bit more risky.

Limitations of the 4% Rule

The 4% rule has a couple of limitations, as such a blanket statement is bound to have. Running out of money during retirement is scary. Let’s be clear here though, it is significantly scarier to run out of money in your 80s than say your 40s and 50s. While running out of money is always scary, it’s significantly more difficult in your 80s as opposed to your 40s and 50s when finding employment is much easier. The 4% rule has a general timeline of 30 years, and while theoretically after 30 years the principal should still remain intact and have grown to account for inflation, it is not 100% guaranteed for this duration, and those planning on retiring significantly earlier than 65 should plan more conservatively.

If you plan to retire earlier than 65, it is not possible in the US to apply for Medicare and healthcare is something that many employees conveniently forget about but a typical family of 4 can expect to pay an average of $25,000 for an Affordable Care Act plan, and approximately $6,000 annually per individual with deductibles potentially reaching up to $7,000 annually.

Another limitation of the 4% rule is that it doesn’t account for an increase in spending. Moving is required sometimes to be closer to family, medical bills arise, families grow, and sometimes after driving the old clunker of a truck for 20 years, you just want a new Tesla. Changes are always happening in our lives, whether they are changes around us or within, and typically these changes will cost money, especially if we are planning for the cheapest of scenarios.

Lastly and more positively, the 4% rule assumes that you will not make any more money after retiring. While this is reasonable to some, earlier retirees tend to pick up jobs that they find enjoyable and often offer some kind of compensation and/or benefit package. The 4% rule does not take into account these earnings, or earnings from a pension fund, rental property income or income from other businesses, or potentially large inheritances.

My Thoughts on Using the 4% Rule

While the 4% rule seems incredibly easy, I think it has to be used with a grain of salt. When starting out I think it can be a fantastic goal. Personally as someone nearly 5 years into my career, I use the 4% rule as a general guideline to determine about how much I want invested but I actively researching and pursuing methods to insure steady passive income.

Early in this COVID-19 pandemic I also had a couple of months where work slowed down significantly and while it was nice to recharge for a couple of weeks, I soon found that I do not do well being idle. I believe I will always want to have some kind of passion or job that will provide money, whether it may be driving Lyft to make $200 a month or working in a brewery two days a week for a sense of community and access to some free beer.

To me, the 4% rule is a plan for retirement and I believe completely that having a plan is better than no plan at all. In my opinion, if someone intends to retire earlier than in ones’ 60’s with no additional passive or active income, it is best to be more conservative and plan for a similar rule but maybe shoot to live on 3% or 3.5% annually. If after 10 years the fund grows significantly it is much easier to adjust one’s spending upwards than to try to cut back or begin earning more money. Having a lower planned withdrawal rate and higher invested value provides an added layer of safety, and when it proves to be much more money than originally intended, having the ability to increase spending will be a significantly better surprise than resorting to finding ways to bring in more money or decrease spending. It is hard enough to know our current spending and what we will spend next year, yet alone knowing what we will spend 20-30 years after retirement.

For one of the best discussions on the 4% rule that considers and recognizes COVID, I strongly recommend a listen to the Bigger Pockets Money Podcast #120 and to hear from Bill Bengen, the inventor if the 4% rule himself during the middle of a COVID-19 spike, listen to Bigger Pockets Money Podcast #153.

– Written by Nick

Nice post. I was checking continuously this blog and I’m impressed!

Very useeful information specially the last part 🙂 I care for such info a lot.

I was looking for this particular information for a long time.

Thank youu and best of luck.

I needed to to thank you for this fantastic read!! I definitely enjoyed every bit of

it. I have got you book-marked to look at new things you post…

Hello there! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would really

appreciate your content.Please let me know. Thanks!

Way cool! Some very valid points! I appreciate you penning

this post and the rest of the website is also really good.

Fabulous, what a web site it is! This web site

provides useful data to use, keep it up.